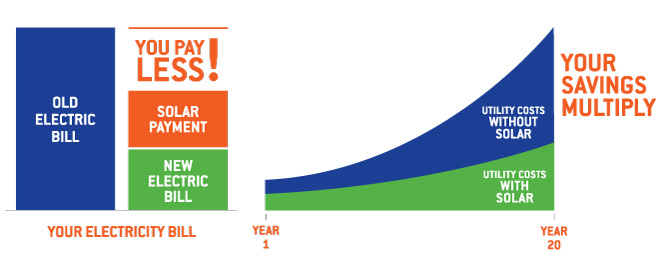

Installing solar panels can help you save money on energy costs for years to come but the initial expense can be overwhelming.

Solar panel credit interest expense included.

Filing requirements for solar credits.

Fortunately the federal government offers some help giving you a 30 tax credit on.

Federal solar tax credit based on the full cost of the system.

5 minutes last updated on august 27 2020.

To claim the credit you must file irs form 5695 as part of your tax return.

The tax credit is only for systems that.

The eligible cost can also include any direct site preparation such as small repairs to the roof surface or a tree removal for sun optimization.

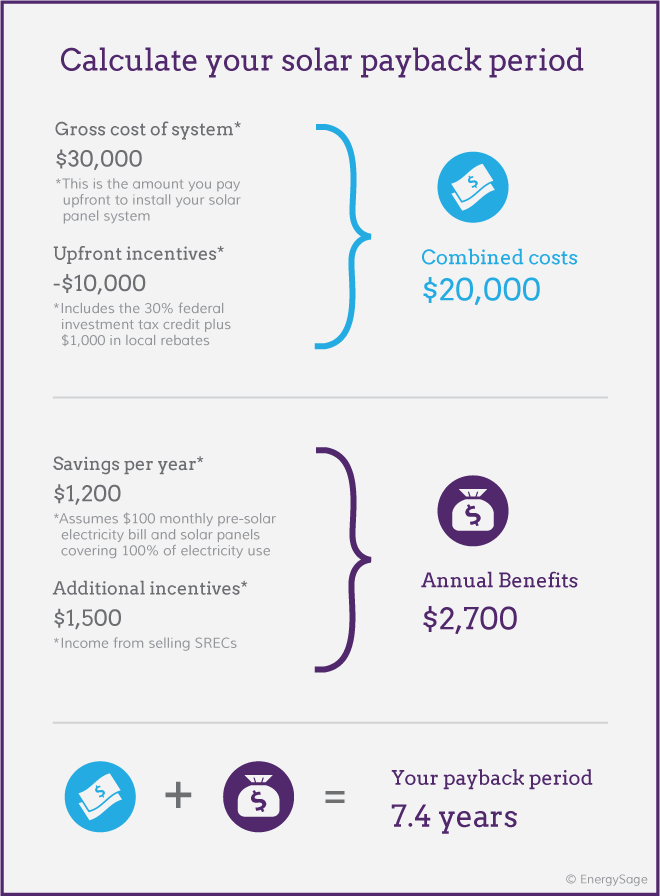

According to homeadvisor the average cost to install solar panels on your roof is 21 429 so with such a high cost is there a possibility to get a tax deduction for a solar loan.

If you install solar panels before the end of 2020 you will receive a tax credit that is equal to 26 percent of the cost of your solar installation.

Adding a third bedroom adding a garage installing insulation landscaping solar panels and more.

If you re considering solar you ve probably heard about the federal solar tax credit also known as the investment tax credit itc the federal itc makes solar more affordable for homeowners and businesses by granting a dollar for dollar tax deduction equal to 26 of the total cost of a solar energy system.

I bought solar panels but have not installed them yet.

Include this home improvement interest expense under the same section as you would home mortgage interest.

1 48 9 k to be included in calculating the energy credit when adding a new roof and solar panels to the property.

If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs.

Additionally eligible costs that qualify for the federal investment tax credit include the equipment directly related to the system such as the solar panels racking inverters wiring and monitors.

For commercial solar energy under sec.

The federal solar tax credit also known as the solar investment tax credit or itc is the single most important solar incentive available in the united states.

You calculate the credit on the form and then enter the result on your 1040.

Examples of capital improvements are.

To enter your mortgage interest in turbotax online or desktop please follow these steps.